If BOX can get annual sales growth up to 20% then it could maybe see profit around 2022/3 at current R&D spend levels, but we also have to factor in interest and taxes.

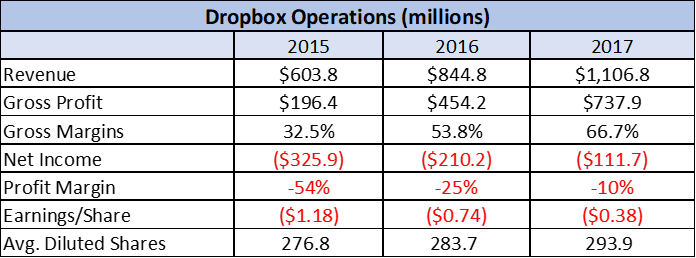

R&D costs have grown to $199 million in the fiscal year, so if the company wants to continue with current trends, then it needs to charge up its sales or the company will still struggle to make a profit in 2024. If we extrapolate the current revenues at 15%, we get the following EBIT results: The average growth rate in cost of revenue is 25%, whilst in Selling/General/Admin it is 7.8%. This has created an average growth rate of 23%, but the overall trend is still in decline. Although revenues are increasing for the company, the growth rate of those revenues is steadily declining. The problem for BOX is a slowing growth rate in annual sales, which is fighting with these other costs. The company had an operating income of -$139m. Selling expenses have also risen from $314m to $420m over this time period, while R&D has also risen from $102.5m to $199.75m. The company currently books a loss on those revenues of -$0.98 per share. Box revenues are growing but growth is slowingīox revenues have continued to rise over the last five years to $696 million. ( NASDAQ: DBX), and discusses their investment attributes.

This article discusses the implications for Box, Inc. All Rights Reserved.The recent virus outbreak has led to an increase in home working arrangements for companies globally and this has boosted demand for collaboration tools. All content of the Dow Jones branded indices © S&P Dow Jones Indices LLC 2019 and/or its affiliates. Standard & Poor's and S&P are registered trademarks of Standard & Poor's Financial Services LLC and Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC. Dow Jones: The Dow Jones branded indices are proprietary to and are calculated, distributed and marketed by DJI Opco, a subsidiary of S&P Dow Jones Indices LLC and have been licensed for use to S&P Opco, LLC and CNN. Chicago Mercantile Association: Certain market data is the property of Chicago Mercantile Exchange Inc. Factset: FactSet Research Systems Inc.2019. Market indices are shown in real time, except for the DJIA, which is delayed by two minutes.

0 kommentar(er)

0 kommentar(er)